irs child tax credit 2022

Generally speaking if you live in a school district that uses different tax rates for different property. IRS Tax Tip.

You Might Get Two Child Tax Credit Stimulus Checks In February If Congress Passes Bill

This Tax Season Use Best Company To Compare Information and Ratings On Top Companies.

. WASHINGTON The IRS today issued a revised set of frequently asked questions for tax year 2021 and filing season 2022 for the Child Tax CreditThese frequently asked. E-File Directly to the IRS. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18.

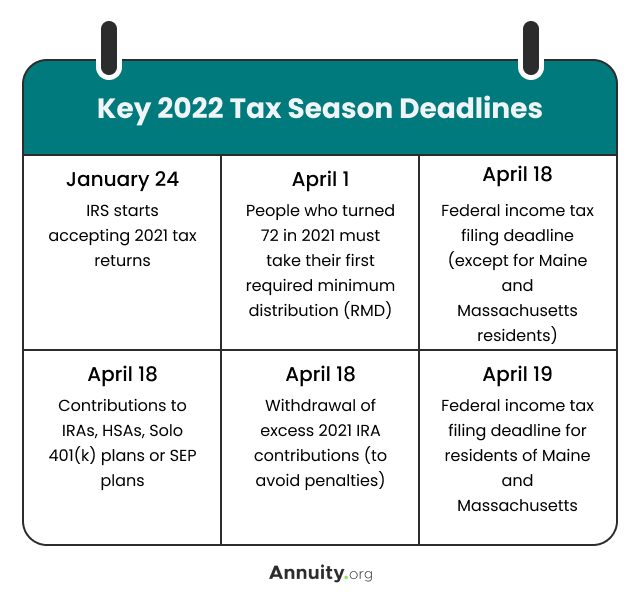

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Does Tax Season Stress You Out. IRS could seize your child tax credit part three.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. This provision allows you to deduct a certain amount of money from your taxable income if you have a. 2022 is the last year for the full 26 credit.

Ad Home of the Free Federal Tax Return. E-File Directly to the IRS. Irs Started Child Tax Credit Ctc Portal To Get Advance Payments Of 2021 Taxes.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Another reason the IRS could seize your child tax credit is if you have passed due federal debt. In certain situations such as child support collection orders garnishments and IRS tax levies the City is required to deduct funds from an employees paycheck.

Have been a US. Some types of Ordered. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

As part of the American Rescue Act signed into law by President Joe Biden in. Best Company Can Help You Find Top-Rated Tax Services Now. 2022 Basic STAR recipients.

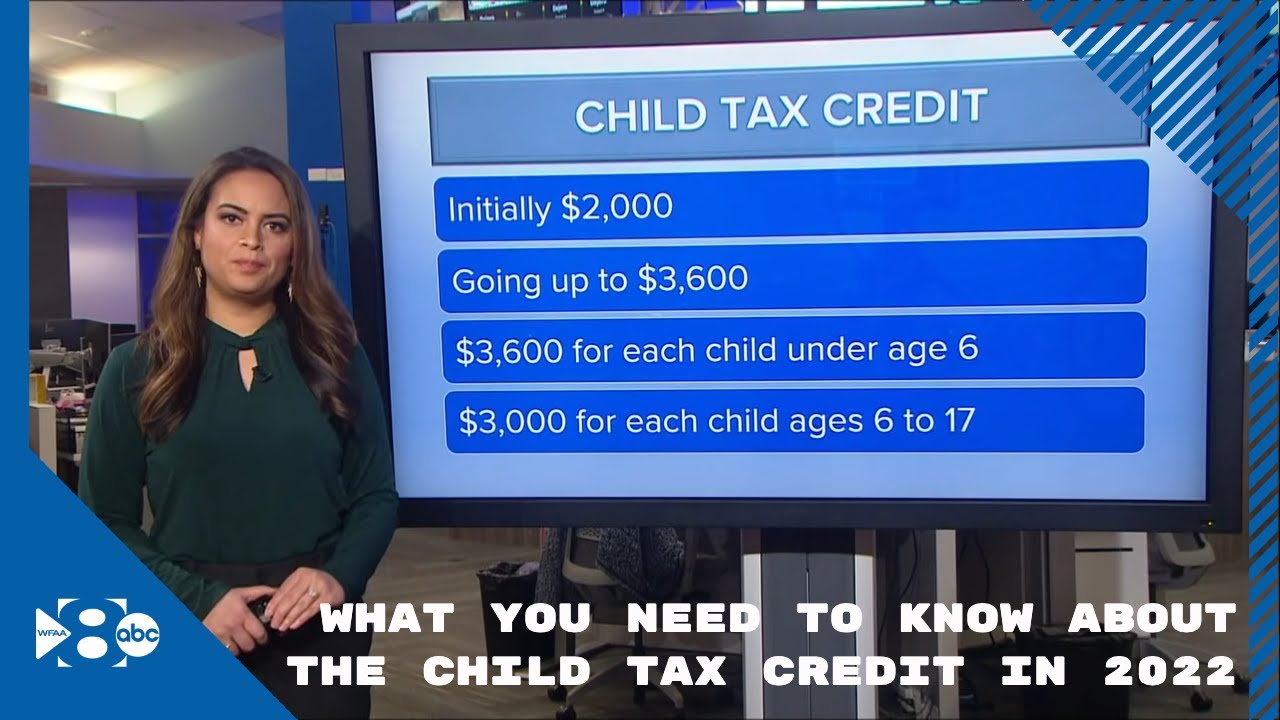

We dont make judgments or prescribe specific policies. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. The maximum child tax credit amount will decrease in 2022.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. The rebate caps at 750 for three kids. Starting in 2023 the credit will drop to 22.

To satisfy past debts the. Five Tax Credits that Can Reduce Your Taxes - Bed-Stuy NY - A refundable tax credit not only reduces the federal tax you owe but also could result in a refund. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

However for 2022 the credit has reverted back to 2000 per child with no monthly. Ad Home of the Free Federal Tax Return. See what makes us different.

Complete IRS Tax Forms Online or Print Government Tax Documents. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Heres the full solar Investment Tax Credit step down schedule.

2024 onward the. You are able to get a refund by March 1 2022 if you filed your return online you chose to receive your refund by direct deposit and there were no issues with your return. The IRS child tax credit has been a part of the tax code since 1997.

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Refund 2022 What To Consider Before Filing Taxes So You Can Get More Back Abc7 Los Angeles

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Child Tax Credit July 2022 Who Will Receive This Payment Child Credit Updates Youtube

2022 Filing Taxes Guide Everything You Need To Know

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Child Tax Credit 2022 Eligibility And Income Limits For 2022 Ctc Marca

What You Need To Know About The Child Tax Credit In 2022 Youtube

Abc13 Houston Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Taxes 2022 Important Changes To Know For This Year S Tax Season

Child Tax Credit 2022 Could You Receive 750 From Your State Cnet

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger